Opinion

Support the diversification of oil companies, an alliance with the devil?

THE TOPS AND FLOPS OF COP26. There is a lot of talk in Glasgow about freeing humanity from fossil fuels, but a collapse of this industry is not necessarily desirable. Isn't it therefore better to support it in its retraining than to attack it head-on?

Our arrival at COP26 was greeted this morning by demonstrations against fossil fuels. It is true that despite the advent of clean, efficient and profitable energy solutions, the petroleum industry is very present in Glasgow, and benefits from massive investments which continue to make it the main source of world energy. No wonder since it represents a huge amount of jobs and profits. How then to bring about a disruption in such a frozen system?

Financially, it remains trapped in colossal investments which have not yet been fully amortized. The temptation therefore remains strong to prolong the status quo as long as possible. On the other hand, the climate call demands urgent change.

The point is that despite all the desires, a total and immediate change is impossible for several reasons. The first is that we still need fossil fuels, otherwise the whole world would collapse, paralyzing transport, heating, industry, agriculture. Even environmental activists could no longer come and demonstrate or print their leaflets. The second is that it employs millions of workers who cannot be abandoned. It may be paradoxical, but a frontal attack to dismantle it would not be to our advantage.

The solution will probably come from elsewhere, now that investments in the oil industry are dangerous and start to look like rotten assets. Pension funds and life insurance companies know that within 10 or 20 years the value of oil assets in their portfolio will be divided by two or three due to inevitable carbon taxes and the development of much cheaper renewable sources. But they must not sell all their shares at the same time, otherwise we will relive a hundred times worse the scenario of the subprime crisis of 2008 with a resounding stock market crash. Even if we don't want to hear it, the fate of the oil companies is linked to ours. If they fall, we will fall. It is therefore vital for everyone, for the climate as well as for our economic survival, that we encourage them to retrain. The financial world has understood this, and so have oil companies.

"We had no choice anyway if we wanted to survive"

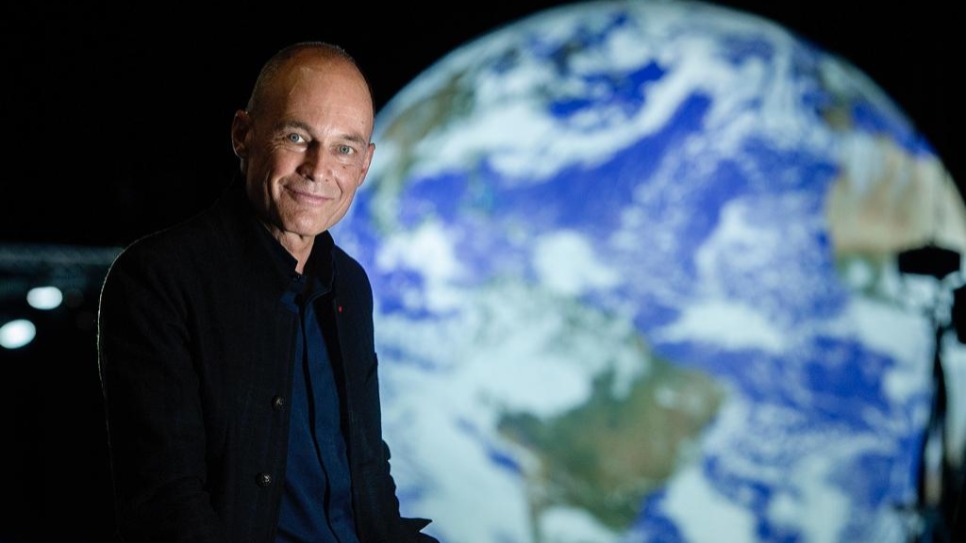

We then see ourselves condemned to make an alliance with the devil to make him less evil! Several redemption opportunities are open to him, and he is beginning to seize them, albeit too timidly: renewable energies have become cheaper than oil, gas and coal over most of the globe and therefore represent a new market. not to be missed, as well as the charging stations for electric cars. Hydrogen is also in the sights of the Majors, because they know how to manufacture, transport and sell compressed or liquid gas. A company like BP has seen its share price increase following its announcement of carbon neutrality for 2050. This shows that the market wants this conversion. When I looked at Total's commitments to reduce its share of oil in favor of biogas, hydrogen and renewable electricity, its CEO confided to me: “In any case, we had no choice if we wanted to survive. "

This does not mean that we can let our guard down. We must continue to put pressure. The commitment last Thursday at the COP26 of twenty-three countries including the United States, Great Britain, France and Brazil, with several financial institutions, to stop funding fossil fuels abroad from here by the end of 2022 and reallocating current investments to renewable energies must be applauded with both hands.

And we, as consumers, what should be our role? In any case not that of designating an external culprit to exonerate ourselves. Because at the end of the day, if oil is produced by companies, we are the ones who consume it. It's not a pleasure to hear, but the bulk of CO2 emissions come from those who use oil, either directly or indirectly. It is therefore also up to us to act, by being more efficient in our consumption, by buying products that have not been around the world before arriving here, by giving up acquiring more than what we have. need.

To accelerate the fight against climate change, we also have to accept the new regulations intended to make fossil fuels less attractive, such as the carbon tax. This still arouses as much resistance among the population as renewable energies from the oil companies. However, one cannot demand that others change without changing oneself as well.